Unleashing a global revolution in Lending technology – empowering financial institutions to scale fearlessly, innovate at speed, and deliver human-centered credit experiences that transform lives.

PhotonMatters powers fast, intelligent, and scalable Lending – for neo-banks, digital lenders, and platforms embedding credit

Scattered and Siloed platforms across origination, servicing, and collections mean fragmented data, broken journeys, and zero end-to-end visibility resulting in fragmented vision.

Launching or updating loan products can take months – delaying innovation and killing first-mover advantage.

Too many handoffs. Too much paper. From onboarding to recovery, manual tasks slow down teams and frustrate borrowers.

Legacy models miss the mark on today’s borrowers – especially thin-file, gig economy, or new-to-credit customers.

Without real-time approvals or intuitive journeys, borrowers abandon the process – costing you conversions and revenue.

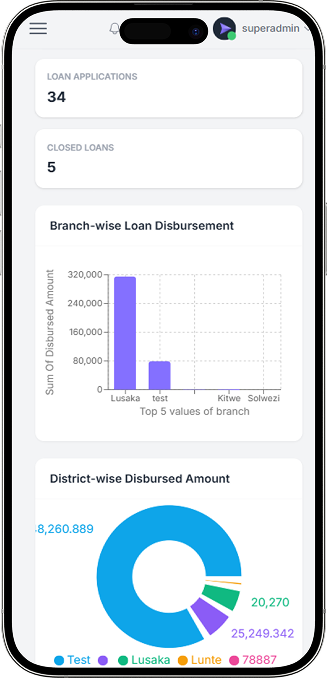

Lack of real-time insights into risk, repayments, and recovery performance results in reactive decisions, not strategic ones.

Can’t offer top-ups? Flexible EMIs? Dynamic pricing? Inflexible backends limit your ability to personalize and compete.

Staying audit-ready and regulator-compliant across geographies is overwhelming without embedded, automation-first governance.

Borrowers expect seamless, omnichannel support — not disjointed handovers between apps, agents, and portals.

Outdated recovery workflows fail to adapt to borrower behavior – leading to rising NPAs and low recovery rates.

Talk to PhotonMatters and launch any kind of Micro, Consumer, Retail, or Commercial products within weeks….

Talk to PhotonMatters and launch any kind of Micro, Consumer, Retail, or Commercial products within weeks….

PhotonMatters a unified Lending platform build for Scale, Speed and Success

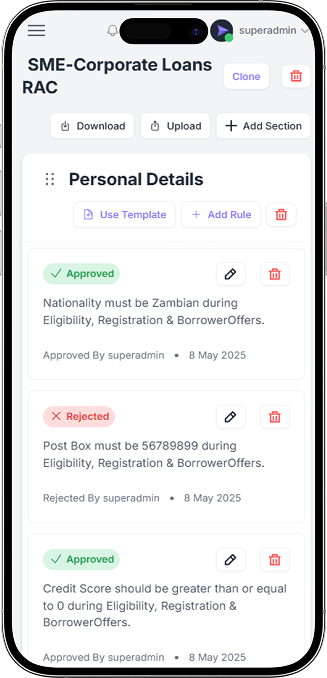

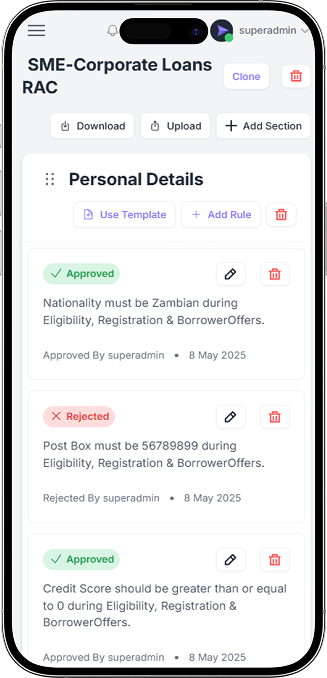

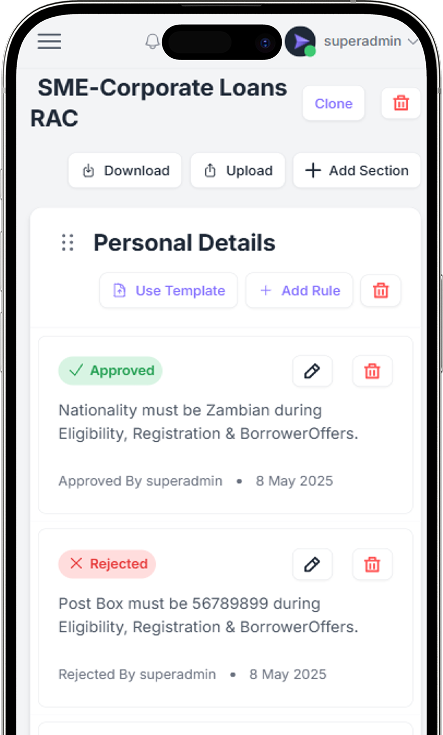

Accelerate loan approvals with our AI-powered Loan Origination System – Fast, Flexible, and built for Scale.

Smarter Loan Management. Seamless Scalability.

Empowering lenders to automate the entire loan lifecycle – from disbursement to collections – with Precision, Compliance, and Real-Time visibility.

Cognitive Credit Decisions. Real-Time Risk Insights.

Delivering accurate, explainable scores using traditional and alternative data – enabling Faster, Fairer lending decisions at Scale.

Supply Chain Finance. Reimagined for Speed and Scale.

PhotonMatters enables anchor-led, buyer-led, and deep-tier financing with Intelligent Workflows, Multi-Party Integrations with real-time visibility.

Intelligent Collections. Better Recovery, Less Friction.

AI-driven Collections Suite helps you Segment, Prioritize, and Automate Recovery – improving efficiency while preserving customer relationships.

Adaptive Campaigns. Higher Conversions.

Design, Target, and Automate lending campaigns with precision – across every channel and lifecycle stage.

From microloans to multi-million credit lines – one platform, endless possibilities. Designed

to flex – across segments, products, and ambitions

Empowering financial institutions with agile micro-Lending solutions designed to serve underserved and emerging markets with precision, speed, and scale.

Flexible, AI-powered personal Lending solutions designed to meet the evolving credit needs of today’s consumers. Whether it’s funding life goals, managing unexpected expenses, or building financial wellness, PhotonMatters enables lenders to deliver instant, human-centric credit at scale.

Scalable, AI-powered commercial Lending solutions designed for businesses of all sizes — from startups and MSMEs to mid-market and enterprise borrowers. PhotonMatters enables fast, compliant, and intelligent credit delivery through configurable workflows and deep data intelligence.

AI-powered, real-time, and seamlessly connected-empowering suppliers, distributors, and manufacturers with instant, flexible working capital to keep the value chain moving.

Everything you need to launch, scale, and innovate in Lending –

on a single, modular, AI-powered platform.

PhotonMatters in India, UAE, USA and Africa

Ahmedabad (India)

Dubai (UAE)

Johannesburg (South Africa)

New York (USA)